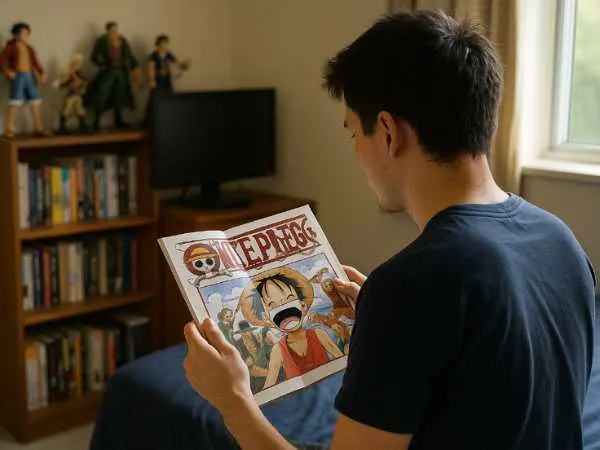

For over 25 years, One Piece has captivated audiences with its epic narrative — but beyond the adventure lies a billion-dollar machine few fully grasp. As one of the most lucrative manga and anime franchises in history, One Piece has built an empire that spans licensing, merchandise, streaming rights, and retail networks. It’s more than just a story; it’s a strategic commercial blueprint that continues to expand — even in Canada, where One Piece fans are fuelling new trends in collector culture and e-commerce. In this article, we’ll uncover how One Piece transformed from a cult manga into a merchandising phenomenon with global reach.

Why One Piece merchandise dominates anime retail in Canada

Across Canada, fans can’t get enough of One Piece figures. Whether displayed in glass cabinets or boxed as long-term investments, these products are more than collector’s items — they’re business assets. The success comes from years of curated branding, licensing foresight, and precise audience targeting. Unlike many anime franchises that fade after a few seasons, One Piece products remain evergreen thanks to character rotation, collector scarcity, and the series’ sustained popularity.

Canadian e-commerce stores, like anime figures specialists, have capitalised on this loyalty. With exclusive pre-orders, limited edition drops, and imported models, they’ve helped grow the domestic market for One Piece merchandise. Retailers understand that Canadian fans aren’t just consumers — they’re collectors, investors, and culture keepers. This buyer sophistication has driven the demand for rare figures, graded items, and event-exclusive collectibles that hold long-term value. Globally, One Piece generates revenue through a complex merchandise chain that includes production licensing, third-party distributors, and direct-to-fan retail models. In Canada, that translates into a niche but high-conversion market, where each release is carefully positioned for emotional and financial return.

The economics behind One Piece licensing deals

Licensing is the heartbeat of the One Piece business model. From apparel and school supplies to household décor and themed restaurants, the Straw Hat brand stretches across dozens of product categories. The key to this success? Targeted, non-saturating partnerships that align with the brand’s values and visual identity. In Canada, licensing for One Piece merchandise is often routed through North American distributors who negotiate regional exclusivity. This makes the Canadian market unique: small enough to test niche items, yet loyal enough to support large-scale promotional campaigns. The economics are calculated — licensors carefully vet local retailers to maintain brand consistency while ensuring financial viability. This strategic focus ensures fans receive authentic, high-quality goods. And behind every licensed T-shirt or figure lies a percentage deal, a brand strategy, and a cultural playbook. It’s a world where every pirate flag printed is a commercial decision based on projected ROI and fanbase analysis.

How Canadian e-commerce transformed One Piece figure sales

The rise of e-commerce in Canada has revolutionised how anime fans interact with products and One Piece is leading that transformation. Once limited to conventions or imported stock, One Piece collectibles are now readily available through a range of Canadian online platforms. These businesses have shifted from simple resellers to full-scale brand curators.

By leveraging SEO, influencer partnerships, and exclusive product offerings, Canadian anime retailers have built specialised storefronts that cater specifically to One Piece enthusiasts. Their strategies often include pre-order campaigns, bundle deals, and content-driven shopping experiences that reflect the series’ rich lore.

Key e-commerce strategies driving growth

Several techniques have helped online stores capitalise on One Piece demand:

- limited pre-order windows

- exclusive Canadian releases

- multi-language product pages

- collector bundle packs

- seasonal campaigns aligned with anime arcs

- user-generated photo reviews

- loyalty programs for repeat buyers

This commercial ecosystem has allowed sellers to tap into a consumer base that sees figures not just as décor — but as investment pieces. Demand forecasting, dynamic pricing, and rare-item auctions are just part of the modern Canadian One Piece e-commerce strategy.

What drives the price of One Piece collectibles?

Price determination in the world of One Piece figures is more art than science. Scarcity, character popularity, manufacturing quality, and timing all influence the final tag. Limited-edition pieces — especially those with holographic packaging or event-exclusive labels — can multiply in price within months. Fans who bought a $60 figure during its initial release may see it reach $300 or more on resale platforms.

Canadian collectors have started to track these price movements with tools and community apps. There’s an emerging trend in treating anime collectibles like stocks, with fan communities discussing “buy and hold” strategies, market dips, and product bubbles. Understanding these trends is essential for both collectors and sellers.

Factors influencing price value in Canada

Regional availability also plays a role. Import taxes, shipping costs, and domestic supply all affect Canadian pricing. Sellers often mark up imported stock due to limited supply, while domestic figures from authorised distributors fetch higher trust — and prices — due to perceived authenticity. Collectors now expect transparency and traceability, often requesting production codes, authenticity certificates, and box condition images. This demand has added a layer of professionalism to what was once a niche fan activity.

How One Piece conventions and fan events impact the market

Anime conventions in Canada — like Anime North in Toronto or Otakuthon in Montréal — play a major role in shaping demand. These events are more than gatherings; they’re sales funnels for merchandise companies and branding goldmines for licensors.

Event-exclusive figures, signed artwork, and limited-edition merchandise create a scarcity-fuelled microeconomy. Vendors often report their highest annual revenue during these conventions, using fan momentum to boost online visibility post-event. One Piece booths are often among the busiest, pulling in both veteran fans and curious newcomers.

For brands, these events are ideal for product testing and fan engagement. Canadian fans are vocal and passionate, making conventions a ground for direct feedback and trend forecasting. It’s where the emotional bond to the franchise turns into real-time sales.

The One Piece business is a case study in fan-first strategy

One Piece has built more than a world — it has built an economy. The key isn’t just wide distribution or flashy figures, but a laser-focus on what fans actually want. In Canada, the growth of online stores, licensing strategy, and figure resale communities is a reflection of that insight. If you’re a fan, a collector, or an entrepreneur — there’s gold in the Grand Line.

Key takeaways

- One Piece merchandise remains high in demand across Canada

- Licensing strategy is central to brand control and revenue

- Canadian e-commerce platforms are driving new sales models

- Collectibles are being treated as long-term investments

- Fan events directly impact product demand and pricing